Financials Options:

Use the Financials Options window to define the options and

defaults that you use for your Oracle Financial Application(s). Values you

enter in this window are shared by Oracle Payables, Oracle Purchasing, and

Oracle Assets. You can define defaults this window to simplify supplier entry,

requisition entry, purchase order entry, invoice entry, and automatic payments.

Depending on your application, you may not be required to enter all fields.

Although you only need to define these options and defaults

once, you can update them at any time. If you change an option and it is used

as a default value elsewhere in the system, it will only be used as default for

subsequent transactions. For example, if you change the Payment Terms for

Immediate to Net 30, Net 30 will be used as default for any new suppliers you

enter, but the change will not affect the payment Terms of existing suppliers.

N: Setup> Organizations > Financial Options

Click on Find

Accounting Financials Options:

Future Periods: Payable displays the number of future periods

you use in your set of books. Payables use this value to limit the number of

future periods you can maintain in the control Payables Periods window. You can

enter invoices in future periods.

GL Accounts

Liability:

Payables assign this account as the default Liability Account

for all new suppliers you enter. You can override this value during supplier

entry. If you use Accrual Basis accounting, then the Liability Account for any

invoice determines the liability account(s) charged when you create accounting

entries for invoices.

Prepayment:

The Prepayment account and description for a supplier site’s

invoices. The financials Option value defaults to new suppliers and the

supplier value defaults to new supplier sites.

Future Dated Payment: If you use future dated payments, then

enter a value for Future Dated Payment account. This value defaults to all new

suppliers and new bank accounts. The supplier value defaults to all new

supplier sites. The bank account value defaults to new payment documents.

When Payables accounts for future date payments, it uses the

Future Dated Payment Account from either the supplier site or the payment

document, depending on the Option you select in the Payment Accounting region

of the Payables Options window.

If you relive liability payment time, this should be an asset

account. If you relieve liability at future date payment maturity, then this

should be a liability account.

Discount Taken:

If you choose to distribute your discounts to the system

Discount Taken Account, Payables uses this account to record the discounts you

take on payments. Use the Payables Options window to select your method for

distributing discounts for your invoices.

PO Rate Variance Gain/Loss: Payables uses these accounts to

record the exchange rate variance gains/losses for your inventory items. The

variance is calculated between the invoice and either the purchase order or the

receipt, depending on how you matched the invoice. These accounts are not used

to record variances for your expense items. Any exchange rate variance for your

expense items is recorded to the charge account of the purchase order. Payables

calculate these accounts during Payables Invoice Validation.

Expenses Clearing:

This account is required when you use the Company Pay payment

option of Oracle Internet Expenses. Payables uses this as a temporary account

to record credit card transactions activity. Payables debit this account when

you create an invoice to pay a credit card issuer for credit card transactions.

Payables credit s this account with offsets to the original debits entries when

you submit Expense Report Import for an employee expense report entered in

Internet Expenses that has credit card transactions on it.

Miscellaneous:

Used only when importing invoices submitted via iSupplier Portal

or XML Gateway.

If you enter a value here then the system uses this account for

all Miscellaneous charges on invoices your suppliers enter in iSupplier Portal.

If you do not enter a value here then the system prorates miscellaneous charges

across Item lines on iSupplier Portal invoices.

The system also uses this value for any miscellaneous charges

your suppliers send in XML invoices. If you do not enter a value here then

import prorates miscellaneous charges across Item lines for XML invoices.

Supplier – Purchasing Financials Options:

The options you define in this region, except for Inventory

Organization, are used s default values for the Purchasing region of the

supplier window. The supplier values default to new supplier sites for the

supplier, which default to new purchasing documents for the supplier site.

Note: If you use the Multiple Organizations Support feature,

values you enter in this window will default to both the supplier and Supplier

Site.

You can override defaulted values during entry of the supplier,

supplier site, and purchasing documents.

Ship-To / Bill-To Location:

The name of the ship-to/Bill-to Location for the system default

value. If the name you want does not appear in the list of values, use the

location window to enter a new location.

Inventory Organization:

You need to choose an inventory organization if you use

Purchasing. You can associate each of your Purchasing operating units with one

inventory item master organization. When you associate your purchasing unit

with an inventory organization, items you define in this organization become

available in Purchasing. You can only choose an inventory organization that

uses that same set of books as your purchasing Operating unit. Do not change

the inventory organization after you have already assigned one to Purchasing.

Encumbrance Financials Options:

To use encumbrance accounting or budgetary control, you must

install Payables, purchasing, and general Ledge. Use this region to enable

encumbrance accounting and to specify the default encumbrance types Payables

assigns to your invoices, and Purchasing assigns to your requisitions and

purchase orders.

If you enable encumbrance accounting or budgetary control,

Purchasing creates encumbrances when you reserve funds for a requisition or

purchase order. If you use the perpetual accrual method in Purchasing,

Purchasing reverses purchase order encumbrances when you inspect, accept and

deliver the units. If you are using the periodic accrual method in Purchasing,

Payables reverses the purchase order encumbrances when you create accounting

entries for invoices.

Payables creates encumbrances when there is a variance between a

matched invoice and the purchase order to which it is matched, and when the

invoice encumbrance type is different from the Purchasing encumbrance type.

Oracle Financials provides two predefined encumbrance types that

you can use to identify requisition, purchase order, and invoice encumbrances:

Commitment and Obligation. You can define additional encumbrance types in Order

General Ledger in the Encumbrance Types window.

Use Requisition Encumbrance:

Enable this option to encumber funds for requisitions. If you

enable this option, Purchasing creates journal entries and transfers them to

General Ledger to encumber funds for purchase requisitions.

Encumbrance Type:

If you enable Use Requisition Encumbrance, you must select an

encumbrance type by which you can identify your requisition encumbrance journal

entries. Purchasing assigns this encumbrance type to the encumbrance journal

entries it creates for purchase requisitions.

Reserve at Completion: If you enable Use Requisition

Encumbrance, indicate whether you want requisition preparers to have the option

to reserve funds. If you do not enable option, only requisition approvers will

have the option to reserve funds.

Use PO Encumbrance:

Enable this option to encumber funds for purchase orders,

purchase order receipt matched invoices, and basic invoices (not matched). If

you enable this option, Purchasing encumbers funds for purchase orders and

Payables encumbers funds for variance during Payables Invoice Validation for

purchase order and receipt matched invoices. If you enable this option and

enter a non-purchase order matched invoice, Payables will encumber funds for it

during Payables Invoice Validation. All Payables encumbrances are reversed when

you create accounting entries. If you enable Use Requisition Encumbrance, you

must also enable this option.

PO Encumbrance Type:

If you enable Use Purchase Order Encumbrance, select a purchase

order encumbrance type by which you can identify your purchase order

encumbrance journal entries. Purchasing assigns this encumbrances type to the

encumbrance journal entries it creates for purchase requisitions and purchase

orders.

Invoice Encumbrance Type:

If you use purchase order encumbrance, select an invoice

encumbrance type by which you can identify your invoice encumbrance journal

entries. Payables assign this encumbrance type to the encumbrance journal

entries that it creates. We recommend that you use an encumbrance type

different from the Purchasing encumbrance types so you can identify invoice

encumbrances.

Tax Financials Options:

Member state:

The location of your company or organization. Payables use this

country name to determine if your company or organization is located in a

member state of the European Union (EU).

VAT Registration Number:

The Value-Added Tax (VAT) registration number for your

organization. Your organization is assigned a VAT Registration Number if you

register to pay VAT. The first two characters of a VAT registration number are

the country code for the country or state where the registered company or

organization is located. Payables print this number on the header of the

Intra-EU VAT Audit Trail Report.

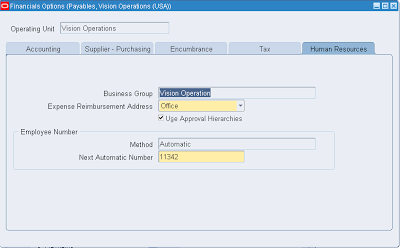

Human Resources Financials Options:

Use this region to enter the options and defaults for entering

employee information in the Enter Person window.

Business Group:

Enter the name of the business group that you want to associate

with Purchasing. If you use Purchasing jointly with Oracle Human Resources, you

must reference the business group that you define in oracle Human Resource. If

you use Purchasing without Human Resources, you can use the default value. The

default for this field is the Human Resources default of Setup Business Group.

The business group determines which employees you can use in

Purchasing. In Purchasing, you can see only the employees in this business

group.

Expense Reimbursement Address:

Select the default address you want to use payments for employee

expense reports: Home or Office. The system uses this default for each new

employee you enter. You can override this default during employee entry or

expense report entry.

Use Approval Hierarchies:

Enable this option to use positions and position hierarchies to

determine approval paths for your documents within purchasing. Disable this

option of you want approval paths based on the supervisor structure.

Employee Numbering Method:

You can enter your employee numbers manually or let the system

generate sequential employee numbers. The system prevents you from entering a

value in this field if you install Oracle Human Resources or Oracle Payroll.

You can change the numbering method at any time.

o Automatic: The

system automatically assigns a unique sequential number to each employee when

you enter a new employee.

o Manual: You

enter the employee number when you enter an employee.

o Use National Identifier

Number: The system automatically enters the employee’s National Identifier

Number as the employee number. For example, a Social Security number for a

United States employee.

Attention:

Be Careful if you switch from manual to automatic entry. The

employee number must be unique. When you use manual entry, you can assign any

number and in any order. If you switch to automatic after having entered

employee number manually, the system many try to assign a number that you

already assigned. If you switch from manual to automatic entry, make sure the

next available number for automatic entry is larger than the largest number you

have already recorded.

Next Automatic Number: If you select the Automatic Employee

Numbering method, enter the starting value you want the system to use for

gathering unique sequential employee numbers, After you enter a number and save

your changes, the system displays the number that it will assign to the next

new employee you enter.

No comments:

Post a Comment